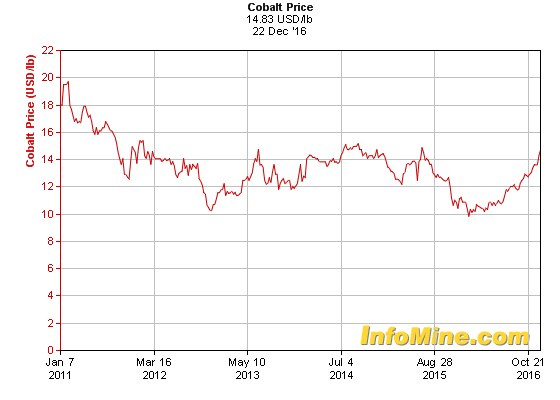

The headline national subsidy for pure battery EVs is set to experience the biggest drop since 2019, declining 12,600 yuan to zero Jan. We previously anticipated an even stronger December quarter in China, with PEV sales being pulled forward from 2023 as consumers make the most of the national subsidies before they expire at year-end. The December window for a strong sales catch-up is hindered by surging cases as the country drops its zero-COVID approach. Passenger PEV sales rose 7.9% month over month in November, lower than the 17.9% increase a year ago. Rising PEV sales in China in October and November were capped by weaker-than-expected overall auto sales as lockdowns extended to more of the key auto-buying provinces. Growth in income and spending will nevertheless follow as the short-term challenges pass, as China redirects its focus toward economic growth again. Chinese epidemiologists are expecting three waves this winter. We expect a surge in COVID-19 infections in China to depress PEV sales, and production disruptions in the PEV supply chain could follow as infections spread. The upstream PEV supply chain is already experiencing lower demand, and expectations of further price falls have scaled back procurement demand for lithium and cobalt. In the short term, however, China's reopening is adding pessimism to the already weak outlook on PEV sales in the March 2023 quarter as the national-level subsidy ends. The much-awaited move brings positivity to the global economy, and to an auto sector that is increasingly being affected by affordability challenges.

We nevertheless forecast lithium and cobalt prices to be pressured over the next few months due to weakening PEV sales and rising COVID-19 infections.Ĭhina dropped its zero-COVID policy at the start of December.We expect China's exit from its zero-COVID policy to benefit the global supply chain and medium- to long-term growth outlooks, despite near-term disruptions caused by new waves of cases, post-reopening.China's cobalt metal price decline accelerated in December on a disproportionate drop in nickel-manganese-cobalt, or NMC, battery production and more cautious inventory management.16, weakening the cost support for lithium chemical prices. The spodumene auction settlement price fell 3.2% Dec.The monthly lithium carbonate CIF Asia price increase slowed to 2.5% month over month in November to $62,500 per tonne, from the staggering 22.0% spike in October.In Europe, passenger PEV sales are benefiting from a bounce-back in the overall car market in November and a jump in the penetration rate before year-end.December provides a narrow window for catch-up sales before the national PEV subsidy ends, although sales are currently challenged by surging COVID-19 cases. China's passenger plug-in electric vehicle, or PEV, sales fell below expectations in November as COVID-19 lockdowns affected more of the key auto-buying regions than in October.S&P Global Commodity Insights discusses the lithium and cobalt markets within the broader macroeconomic environment and provides five-year supply, demand and price forecasts.

0 kommentar(er)

0 kommentar(er)